Residents in Monroe New York use their FSA and HSA accounts to cover out-of-pocket expenses for dental treatments their insurance policy refuses to cover. These helpful accounts are often opened through an employer that offers the opportunity to their employees. The following information will help you better understand FSA and HSA accounts and help you determine if it’s something that will benefit you.

HSA Accounts

Health Savings Accounts (HSA) are available for employees who are enrolled in a high-deductible dental insurance plan. This account reduces your taxable income and allows you to make contributions that can be used towards eligible dental care treatments and procedures.

Benefits of Having a Health Savings Account

- Your contributions are pre-tax when the account is opened through your employer

- No taxes on the account’s growth

- You can depend on the account when you need it

- It’s easy to use

- No tax is charged if withdrawals are made for eligible treatments

- It’s tax-deductible if you open your own HAS

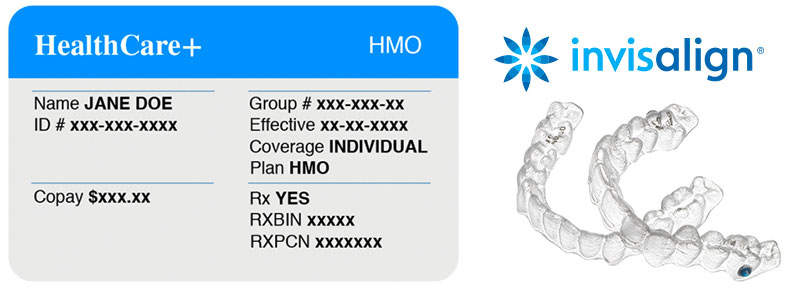

Schedule your no-obligation Invisalign consultation in Monroe, NY today

by calling 845-782-4288 or fill out the contact form to receive additional information.

Save up to $1,000 on Invisalign orthodontic treatment to correct misaligned teeth.

We accept insurance, financing, HSA, and FSA.

A Health Savings Account covers the following dental care:

- Orthodontia

- Dental services

- Dental procedures

- Dental implants

- Dental sealants

- Artificial teeth

- Dentures

- Denture adhesives

- Dental brush

- Denture cleaning supplies

- Denture stain cleaner

- Prevention of dental disease

- Alleviation of dental disease

FSA Accounts

Flexible Spending Accounts (FSA) is set up through your employer via the Human Resource department. An FSA account allows you to make deposits into the account that can be later used to pay for out-of-pocket expenses related to dental procedures and treatments your standard insurance policy won’t cover.

Benefits of Having a Flexible Spending Account

- It’s dependable

- Convenient

- Easy to use

- It covers out-of-pocket expenses

- Your contributions are tax-free

A Flexible Spending Account covers the following:

- Dental services

- Orthodontia

- Dental implants

- Artificial teeth

- Dental procedures

- Dental sealants

- Alleviation of dental disease

- Prevention of dental disease

- Dentures

- Denture stain cleaner

- Denture cleaning supplies

- Denture brush

- Denture adhesives

HSA and FSA vs. Standard Dental Insurance

Chances are your dental insurance doesn’t cover the treatments and procedures you think it does. Carefully review your dental insurance policy to learn more about the costs you can expect them to cover.

Consumers in Monroe, NY and Orange County are often disappointed to learn their dental insurance policy doesn’t cover all of the costs required to have overall good oral health. An HSA and FSA account is there for you when your dental insurance policy drops the ball and causes you to pay out-of-pocket.

HSA and FSA accounts provide you with the financial support and confidence you need to cover dental treatments and procedures. There’s nothing worse than finding out you need specific treatment and not being able to afford it because your insurance doesn’t cover the full cost. This scenario is the reason why residents in Monroe, New York use their HSA and FSA accounts to cover dental care expenses.

Schedule your no-obligation Invisalign consultation in Monroe, NY today by calling 845-782-4288 or fill out the contact form to receive additional information. Our office is conveniently located near 70 Gilbert Street, Suite 202 Monroe, NY 10950.

Save up to $1,000 on Invisalign orthodontic treatment to correct misaligned teeth.

We accept insurance, financing, HSA, and FSA.